Renewable gas ‐ Deployment, markets and sustainable trade

Renewable gases will be key components of a global energy system aiming at net zero greenhouse gas emissions by 2050. With global fossil gas demand decreasing in emission reduction scenarios, biomethane and hydrogen (H2) will be most critical, with biomethane as the largest contributor, as it can be used without changing gas transmission/distribution infrastructure or end user equipment.

This project was conducted in a collaboration between different IEA Bioenergy Tasks. The reports provide state-of-the-art overviews on prospects, opportunities and challenges for deploying biogas, biomethane and other renewable gases in energy markets. It discusses technological and sustainability issues of renewable gases from a deployment perspective, derives recommendations for policymakers, and identifies open research issues.

The results of the project are captured in three separate reports (see below).

A summary is available here:

Renewable gas ‐ Deployment, markets and sustainable trade

Report 1 – Biomethane – factors for a successful sector development

Report 1 – Biomethane – factors for a successful sector development

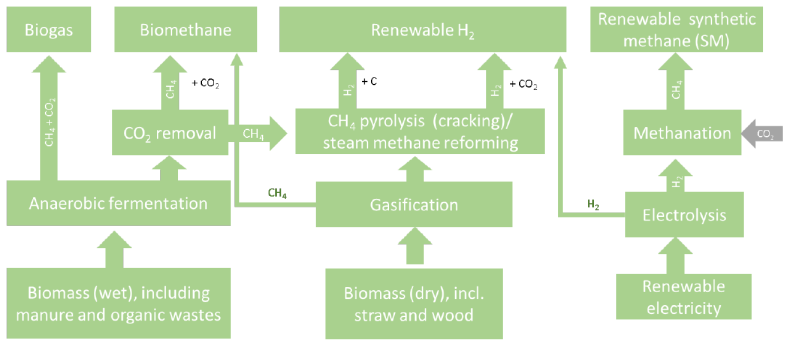

- Biomethane provision based on anaerobic digestion (AD) processes is a proven technology with numerous applications worldwide – with a variety of substrates used and technologies for gas production, upgrading and utilization. Currently, biogas use is dominated by combined heat and power (CHP) units. Since upgrading and grid injection is costly for smaller-scale sites, CHP will remain the technology of choice for those aiming at high heat utilization and flexible electricity provision to balance market prices. Nevertheless, upgrading the biogas to biomethane gets increasing attention, as it can be used without changing gas transmission/distribution infrastructure or end user equipment.

- Under normal market conditions, biomethane is not cost-competitive to fossil energy carriers like natural gas. However, the basis of comparison for renewable energy carriers in the future needs to consider the necessary reduction of CO2 emissions, and therefore, the long-term transition to a decarbonized economy requires CO2 pricing. There are numerous systems and approaches to incentivise the production or the utilization of biomethane. With an obligatory development target for renewable fraction of the market, set e.g., by a quota, a defined market share for renewables can force a development. In the long-term, any support mechanism shall be replaced by a competitive market scheme.

- Strategies and incentives to develop the sector need to reflect the available substrates for biomethane production, the specific costs for the improved access of substrates and gas provision. Since the investment has usually long amortisation periods, the duration of temporal guarantee of the incentive is highly important. Biomethane can contribute but not meet the full demand for renewable gases. Therefore, interaction and compatibility with other renewable gases such as hydrogen (H2) is recommended. Technologies which can be combined with biomethane plants – such as Power-to-gas – need to be included in the strategy to capitalize on synergies and enable most benefit in regards of greenhouse gas abatement, considering existing and needed infrastructure (e.g., natural gas grids).

- Biogas upgrading to biomethane is also a valid source of CO2 for bioenergy with carbon capture and sequestration (BECCS) which achieves negative CO2 balances, and for bioenergy with carbon capture and utilization (BECCU) which can deliver CO2-neutral products.

Report 2 – Status and perspectives of non-biogenic renewable gases

Report 2 – Status and perspectives of non-biogenic renewable gases

- As indicated, interaction of biomethane with other renewable gases from non-biogenic sources is recommended. Non-biogenic renewable gas, encompassing hydrogen (H2) produced by electrolysis powered by renewable electricity and potential subsequent methanation with captured CO2 (power-to-gas) are potentially important routes to decarbonisation of energy and chemical feedstock use, especially in hard-to-abate sectors. A growing number of countries have released national hydrogen strategies that seek to position hydrogen in their decarbonisation plans.

- Most strategies focused on green hydrogen have common themes including: an expectation that the first deployment of green hydrogen will be in industries that already consume fossil-derived hydrogen such as oil refining, and fertilizer and chemicals production; a focus on heavy duty transport such as buses and trucks; a focus on the co-benefits of hydrogen use including reduced GHG emissions, improved air quality, reduced reliance on fossil fuel imports.

- The use of excess electricity as the sole power source for electrolysis is shown to be cost ineffective due to the low electrolyser capacity factors caused by the infrequency of excess electricity availability. On the other hand, the economic and environmental feasibility of using grid electricity to maintain high electrolyser capacity factor show strong dependences on regional factors including the price of grid electricity, its GHG intensity and the relative price of renewable electricity generation.

- In all cases, methanation of hydrogen using captured CO2 to synthetic renewable methane significantly increases abatement costs, but this must be balanced against the benefits of being able to use existing natural gas infrastructure and appliances. In the case of methanation using CO2 from industrial sources, this high abatement cost is due to the GHG intensity of the CO2, which is generally of fossil fuel origin. For methanation using CO2 sourced from direct air carbon capture (DACC), the high capital and operating costs of DACC itself lead to high CO2 prices and therefore to high abatement costs for RM. The lowest abatement costs for synthetic methane are seen for CO2 captured from biomethane and bioethanol plants, which combine CO2 of renewable origin with relatively low CO2 capture price due to high CO2 concentration in off-gases.

Report 3 – Sustainable potentials for renewable gas trade

Report 3 – Sustainable potentials for renewable gas trade

- Renewable gases (RG) will be key components of a global energy system aiming at net zero green-house gas emissions by 2050. RG will have to strongly increase, and international trade may become an important component of decarbonizing the global energy system. International trade of RG can be either physical through gas pipelines (or as liquefied gases in ships), or virtual through the exchange of certificates such as Guarantees of Origin.

- In the short- and medium term, biomethane is the major RG being traded internationally, and prospects for further growth are significant in Europe but also in Latin and North America and South-East Asia, where current trading is rather low.

- In the longer-term, “green” H2 has a high potential for international RG trade. The 2050 potential green H2 exporting countries are seen as those offering low-cost renewable electricity for H2 production, i.e., wind- and sun-rich regions with access to international pipelines and/or ports in Africa (e.g., Morocco), Europe (Portugal, Spain), Latin America (e.g., Chile), Middle East (e.g., Saudi-Arabia), and Oceania (Australia and New Zealand).

- H2 trade will rely on existing gas pipelines and new dedicated H2 pipelines, or transport with ships (ammonia, LH2). Up to 1/3 of green H2 will be traded internationally.

- For trade of green H2 and its derivatives, regulatory hurdles remain, especially the definition of “greenness” and respective GHG emission thresholds, but ongoing work in the EU and internationally aims to address these issues.