Towards an improved assessment of indirect land-use change – Evaluating common narratives, approaches, and tools

The full report is available here

This report – produced by experts involved in IEA Bioenergy Task 43 (biomass supply) and Task 45 (sustainability) – evaluates approaches used to estimate the international impacts of increases in production and use of biofuels. It evaluates effects on commodity markets and land use by comparing model projections to statistical data, focusing on nations with extensive biofuel experience: the United States and Brazil. It focusses on the period after the introduction of the U.S. Renewable Fuel Standard (RFS) in 2005, evaluating studies that assess indirect effects of increasing corn use for ethanol production. The research identified two distinct narratives and explains how these approaches are built on assumed causal relations between biofuel production, crop markets and land-use change. The two narratives tend to generate divergent results based on how questions are framed and the corresponding modelling assumptions.

- The “Trade and Market Response” narrative asserts that biofuel markets create a shock in demand to an otherwise stable market equilibrium, and in response to this shock, capital and land markets adjust (other variables are typically assumed to be held constant). More inputs of land (crop area expansion) and capital (e.g., to support yield improvements) are required to meet the new demand. Under the “Trade and Market Response” narrative, increasing U.S. biofuel production drives deforestation in Brazil, via increasing U.S. corn prices causing a decline in U.S. corn and meat exports and subsequent expansion of production and exports by Brazil.

- Under the “Internal Adjustment Response” narrative, the biofuel demand is foreseen and latent capacities in the production system respond as they do for other simultaneously changing demands (e.g., changing population and preferences, declining demand for corn-based feed and sweeteners). Under the “Internal Adjustment Response” narrative, U.S. biofuel production increases based on the capacity of domestic suppliers with negligible indirect impacts on food and land markets outside the U.S.

The report examines a series of models to estimate how well results align with observational data.

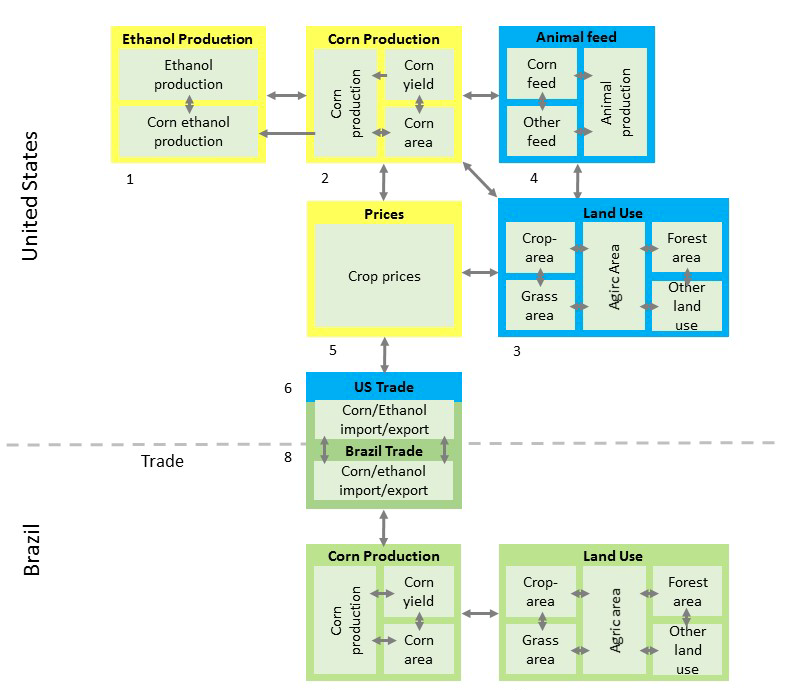

The analytical framework presented in the report evaluates selected crops, crop prices, land use, food and ethanol production, and trade activities focusing on the U.S. and Brazil. A conceptual framework is provided to illustrate how implementation of the biofuel policy in the U.S. is hypothesized to drive indirect effects in other nations (see figure below). Statistical analyses have found that U.S. corn prices respond directly to domestic corn production but not necessarily to corn ethanol production.

The two main narratives discussed in the report lead to conflicting conclusions. As more data accumulates since the introduction of the U.S. biofuels policy, evidence increasingly questions key relationships assumed in the Trade and Market Response models. For example, recent analyses found no statistical evidence for an expansion of U.S. ethanol production to be a causal driver for changes in corn prices, U.S. corn exports, or deforestation in Brazil.

There is a need for research to develop and test analytical tools that can better quantify actual effects of biofuel production and policies based on evidence. It is recommended to include, at a minimum, the following elements in future analyses that aim to assess indirect effects of bioenergy policy on land use:

- Long-term trends for factors analysed, avoiding two-point comparisons

- Data on harvested areas and multiple cropping

- Crop yields

- Trends in seed, machinery, and labour input

- Full national land balances (accounting for all land in all classes, not just selected crops; and including grassland, forest and non-agricultural land cover)

- Trend data should consider the area planted in individual crops, secondary or cover crops, and management over 12-month agricultural years, considering rotations over time (crop matrix) for historic observations (baselines) as well as counter-factual and simulated scenarios

- Explicit long-term evaluation of changes in national and global crop prices and export volumes

- Causality checks (complete linkage, weight of evidence, etc.) of assumed relationships

A more robust and comprehensive approach could provide improved assessments of the effects of policy on land management and land cover, including the corresponding net effects on carbon cycles and climate forcing.

The report will be presented and discussed in details in IEA Bioenergy webinar “Understanding Indirect Land-Use Change (ILUC) and Why Reality is a Special Case”, organized by Task 43 (Biomass Supply in Sustainable and Circular Economies) on Wednesday 28 June, 15.00-16.30 CEST / 09.00-10.30 EDT.

Figure: Analytical framework that links developments in U.S. ethanol production to domestic and distant changes in corn markets, production, land use, and trade. Potential indirect effects are illustrated in blue and green as prices influence other markets and land use.